Der Markt für unbemannte Fluggeräte ist im Umbruch. In der aktuellsten Marktstudie von FlyNex zeichnet sich ein neues Bild ab, wo die Reise für Flugtaxis, Transport-Drohnen und Industrie-UAVs hingeht. Besonders der Entwicklung des gewerblichen Bereiches ist mehr als je zuvor Beachtung zu schenken. Seit sich die fortgeschrittene Technologie und Wirtschaftlichkeit von UAVs in den letzten 24 Monaten deutlich verbessert hat, boomt der industrielle Drohnenmarkt.

In Deutschland sind insgesamt über 430.000 Drohnen im Umlauf. Davon allein 90 % im Privatgebrauch. Auch wenn die Anzahl der gewerblich geflogenen Drohnen mit ca. 45.000 Stück noch klein ist, machen diese mit 738 Millionen Euro ganze 88 % des Drohnenmarktes aus. Deutschlands kommerzieller Drohnenmarkt ist damit im internationalen Vergleich auf Platz 4 nach den USA, China und Japan. Im europäischen Vergleich sogar auf Platz 1. (Quelle: BDL, Stand: März 2021)

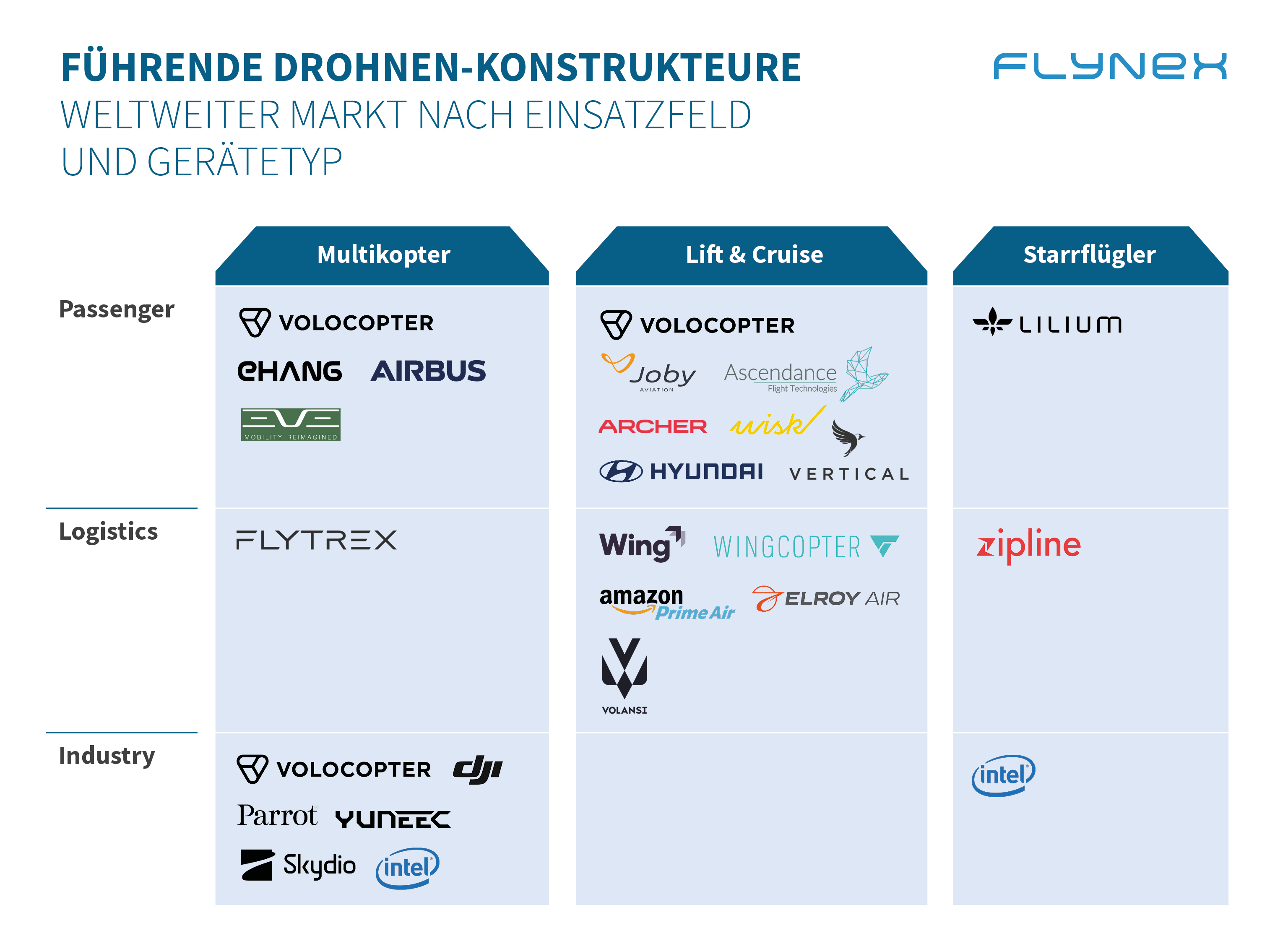

Es zeigt sich also, dass im kommerziellen Drohnenmarkt enormes Potenzial steckt. Daher gibt es auch immer mehr Drohnenhersteller, die Drohnen speziell für gewerbliche Einsätze bauen. Im Wesentlichen lassen sich drei große Einsatzfeder von unbemannten Fluggeräten definieren:

a) Passenger: Der Individualverkehr mit unbemannten Flugtaxis ist der wohl prestigeträchtigste Anwendungsbereich. Jedoch ist der Bereich „Passenger“ gleichzeitig das Feld mit dem geringsten Reifegrad. Aktuell gibt es keinen Anbieter in Europa, der vollständig unbemannt eine Betriebsgenehmigung für innerstädtische Flugtaxis vorweisen kann. Die Geräte von vielen Anbietern sind derzeit noch in einem Test- und Entwicklungsstadium.

b) Logistics: Industrielle Logistiklösungen mit unbemannten Fluggeräten erleben derzeit ebenfalls wachsende Aufmerksamkeit. Nichtsdestotrotz sind in aller Regel die Betreiber noch in Pilot-Projekten und Erprobungsphasen. Das Last-Mile-Geschäft, hauptsächlich geprägt durch die Player Amazon und UPS, versucht hier skalierbare Lösungen zu entwickeln.

c) Industry: Der Bereich mit dem höchsten Reifegrad ist ebenso stark diversifiziert, wie technologisch anspruchsvoll. Agrar, Construction, Medical, Energy – Eine Vielzahl an Verticals setzt inzwischen Drohnen ein für Anwendungsfälle des Transports, Inspektion, Dokumentation und Vermessung.

Drohnenhersteller – Wer sind die Marktführer?

Der größte Hersteller kommerzieller Drohnen ist weltweit DJI. Der chinesische Marktriese generiert einen jährlichen Umsatz von über 2,8 Mrd. US-Dollar (Stand: 2017). Mit einer Vielzahl von Multikoptern bedient DJI den Drohnenmarkt nicht nur auf professioneller Ebene, auch im privaten Bereich sind DJI Drohnen mit Abstand am beliebtesten. Ein Blick in andere Anwendungsbereiche zeigt allerdings noch weitere Unternehmen, von denen wir in den nächsten Jahren sicher noch mehr hören werden.

In der folgenden Grafik haben wir die größten Hersteller aufgegriffen und nach Gerätetyp und Einsatzfeld kategorisiert.

Gerätetypen

Einsatzfelder

Wie entwickelt sich der Markt zukünftig?

Obwohl die meisten Drohnen zurzeit Hobby-Geräte sind, zeigt sich an der rückläufigen (-14,5 %) Marktentwicklung, dass es hier in ein paar Jahren zu einer Sättigung kommen wird. Währenddessen wächst die absolute Zahl der semiprofessionellen und professionellen Geräte für gewerbliche Anwendungsfälle.

Der kommerzielle Markt wird weiter rasant wachsen. Der BDL erwartet ein durchschnittliches Marktwachstum von 16,1 %, was bis 2025 eine Markt-Wertsteigerung um 1,5 Milliarden Euro bedeutet. Die Anzahl kommerziell genutzter Drohnen erreicht bis 2025 voraussichtlich 132.000 Stück. Das ist eine Steigerung von 200 % im Vergleich zu heute. Das bedeutet dann, dass jede dritte Drohne ab 2025 kommerziell in Gebrauch ist. Die Professionalisierung der Technologie und damit des Angebots ist ein Schlüsselfaktor für die weitere Marktentwicklung.

Wir wünschen weiterhin sichere Flüge,

Ihr FlyNex Team